For new parents, childcare is often the largest expense in the early years — sometimes costing more than housing or even a mortgage. In 2025, parents across the U.S. are paying anywhere from $12,000 to $40,000 per year for care, depending on which option they choose: daycare, nanny, or stay-at-home parenting.

This in-depth guide breaks down the real costs of childcare in 2025, the pros and cons of each option, hidden trade-offs, and strategies to make it all more affordable. If you want to discuss childcare costs further, you can do so here.

💵 The State of Childcare Costs in 2025

- National averages:

- Daycare: $1,200–$1,600/month ($14,400–$19,200/year).

- Nanny: $2,500–$3,500/month ($30,000–$42,000/year).

- Stay-at-home parent: Direct childcare cost = $0, but potential income loss $30,000–$60,000+.

- Regional differences:

- Urban areas like New York, San Francisco, and Washington D.C. regularly top $25,000/year for daycare and $50,000+ for nannies.

- Rural areas may average closer to $800/month for daycare.

- States with stronger family leave policies (California, New Jersey) offset some costs in the first year.

👉 Big picture: Childcare eats up 20–40% of household income for many families. See more info on The Real Costs of Baby’s First Year.

🏫 Option 1: Daycare

Average Cost: $1,200–$1,600/month per child

Pros:

- Structured daily routine and curriculum.

- Built-in socialization with peers.

- Licensed staff and safety regulations.

- Often cheaper than hiring a nanny.

Cons:

- Fixed hours; late pickups = extra fees.

- Higher risk of illness exposure (common colds, flu).

- Harder with multiple kids — costs double or triple.

- Long waitlists, especially in major cities.

Real Example (2025):

- In Chicago, infant daycare averages $1,478/month.

- In San Francisco, many parents report $2,100–$2,500/month.

- In small-town Iowa, daycare can be $700–900/month.

Hidden Costs:

- Enrollment fees ($100–300 annually).

- Extra charges for meals, diapers, or supplies.

- Transportation costs if daycare isn’t nearby.

🧑🍼 Option 2: Nanny

Average Cost: $2,500–$3,500/month

Pros:

- Personalized, one-on-one care in your home.

- Flexible hours tailored to your schedule.

- Fewer sick days compared to daycare exposure.

- Convenience — no drop-offs or pickups.

Cons:

- Significantly more expensive for one child.

- You’re an employer — must handle payroll, taxes, and compliance.

- Socialization is limited compared to daycare.

- Nannies may need vacation, sick leave, and raises.

Real Example (2025):

- New York City: Full-time nanny = $25–$35/hour ($50,000–$70,000/year).

- Texas suburbs: Average $18–$22/hour ($36,000–$45,000/year).

- Nanny share: Two families split one nanny, bringing the cost down to ~$1,500–$2,000/month each.

Hidden Costs:

- Employer payroll taxes (~10–12% on top of wages).

- Worker’s compensation insurance (required in some states).

- Year-end bonuses and holiday pay.

🏡 Option 3: Stay-at-Home Parent

Direct Cost: $0

Opportunity Cost: Loss of one income (commonly $30,000–$60,000/year or more).

Pros:

- Strong bonding and total parental control.

- Flexible daily routines.

- Lower exposure to illness cycles.

- May save on commuting, work clothes, and lunches.

Cons:

- Loss of salary, retirement contributions, and career growth.

- Potential isolation for both parent and child.

- Re-entry into workforce later may mean lower wages.

- Family finances rely heavily on one income.

Hidden Costs:

- Missed employer 401(k) match (average = $2,000–$4,000/year).

- Loss of health insurance if coverage was through the at-home parent’s job.

- Impact on Social Security credits if not earning.

Real Example:

- A couple in Seattle with combined income of $120,000 found that after daycare ($20,000) and commuting costs, the second parent’s net contribution was only ~$12,000/year — making staying home a reasonable choice.

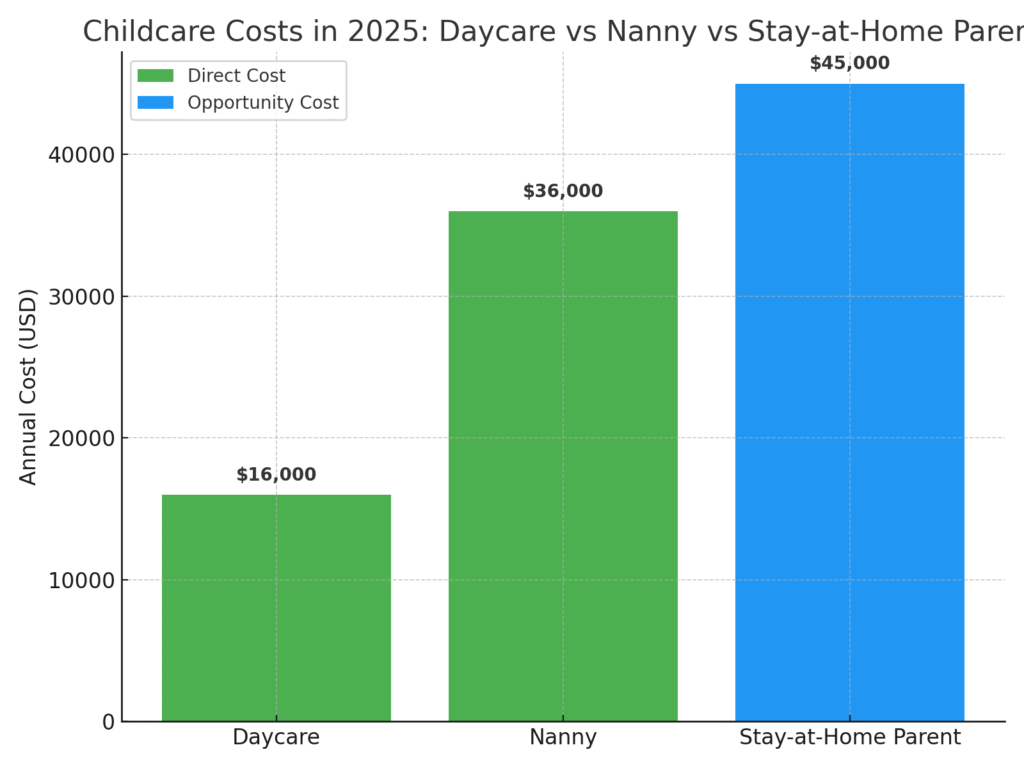

📊 Side-by-Side Cost Comparison

| Option | Direct Cost | Opportunity Cost | Total Impact |

|---|---|---|---|

| Daycare | $14,400–$19,200/yr | Low | Mid-range |

| Nanny | $30,000–$42,000/yr | Low | High |

| Stay-at-Home Parent | $0 | $30,000–$60,000+ | High |

🧾 How to Lower Childcare Costs in 2025

- Dependent Care FSA: Pre-tax contributions up to $5,000/year (if employer offers).

- Child Tax Credit: Up to $2,000 per child (income limits apply). See if you qualify with ChildCareTaxCreditEstimator!

- Childcare subsidies: Many states offer sliding-scale assistance.

- Employer perks: Some large companies provide childcare stipends or on-site centers.

- Nanny share: Splitting one nanny between two families.

- Part-time daycare: 2–3 days/week combined with parent/family care.

- Flex schedules: Parents alternate work-from-home or shift work.

📈 Long-Term Financial Impacts

- Daycare: Preserves both parents’ careers but can consume 20–30% of income.

- Nanny: Highest cost but highest flexibility — worth it for parents with demanding jobs.

- Stay-at-home parent: Saves money in the short term, but can reduce lifetime earnings by hundreds of thousands due to career breaks.

👉 Rule of Thumb: If childcare costs exceed 30–40% of take-home pay, explore alternative arrangements.

🧩 Case Studies

Family A: Daycare in Suburbs

- Dual-income household: $90,000/year.

- Daycare: $15,000/year (~17% of income).

- Decision: Affordable enough to preserve two careers.

Family B: Nanny Share in City

- Household income: $150,000/year.

- Nanny share: $20,000/year ($40,000 split between two families).

- Decision: Balanced flexibility + affordability.

Family C: Stay-at-Home Parent in Midwest

- Household income: $70,000/year.

- Daycare would cost $14,000/year (20% of income).

- Parent chose to stay home, sacrificing ~$30,000 salary but saving on childcare and commuting costs.

🌟 Final Thoughts

Childcare in 2025 is expensive — but families have options. Whether you choose daycare, a nanny, or staying home, the key is to look beyond surface costs and consider:

- Long-term financial impact.

- Family values and lifestyle preferences.

- Opportunities for hybrid solutions (flex work, nanny shares, part-time daycare).

With planning, transparency, and creativity, you can make childcare work without derailing your family’s finances.

📣 Join the Conversation

Which childcare option are you considering for your family, and why? Share your experience in the Parent Finance Forum — your insight could help another parent make the best decision.

2 thoughts on “👶 Childcare Costs 2025 Explained: Nanny vs. Daycare vs. Stay-at-Home in 2025”